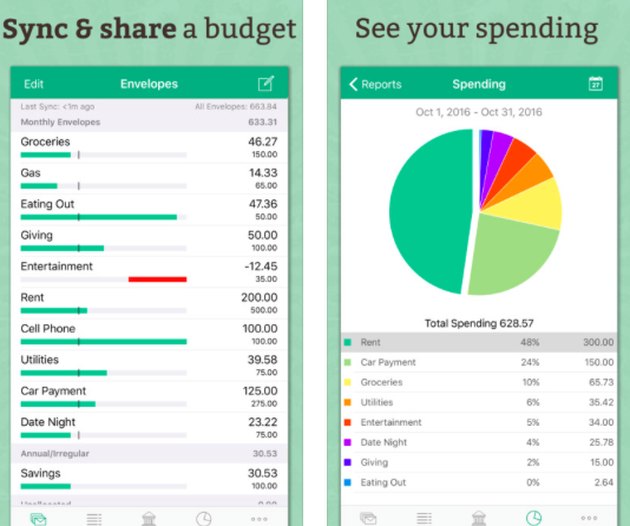

Next, record your spending habits manually or automatically import them from your bank accounts. If you have money left over, start budgeting for your true expenses (the ones that will happen eventually, but not monthly).Ĭontinue allocating your money until the number hits zero. Assign your money into categories manually or use the auto-assign feature. The YNAB app encourages you to leave room for the fun stuff, so you should input savings goals and budget categories like eating out, drinks with friends, and vacations.Ĭonnect your bank accounts (checking, savings, and credit cards) to the app and start assigning money to each category. Ballpark a rough cost for each category and input it on the app. To get started with the app, make a list of your weekly, monthly, and non-monthly expenses.

YOU NEED A BUDGET APP COST HOW TO

Get You Need A Budget (Free 34-Day Trial) How to Use YNAB In essence, you should be spending last month’s pay on this month’s expenses.īy doing so, you are not relying on money you just earned this month – you have some breathing room.Įventually, by following the three other rules, this one should come easily.īy being more purposeful about spending, you will spend less than you earn, and your money will bank up. The goal of this last step is to be spending money that is at least 30 days old. There are no set rules or budgets, making it super flexible to move money around to wherever it’s needed.

YOU NEED A BUDGET APP COST FREE

You should try to free up money in another category and move it to the one where you spent more that month. This works by simply adjusting your budget categories if you overspend. The third rule is called “roll with the punches,” because you should be flexible and take care of overspending as it happens. This way, you’ll look ahead by slowly paying off the large expenses in manageable monthly payments without worrying about any debt piling up.

YNAB encourages you to take large, less frequent expenses and break them down into recurring monthly “bills.” Instead of stressing out about every spending decision, simply consult your budget plan.

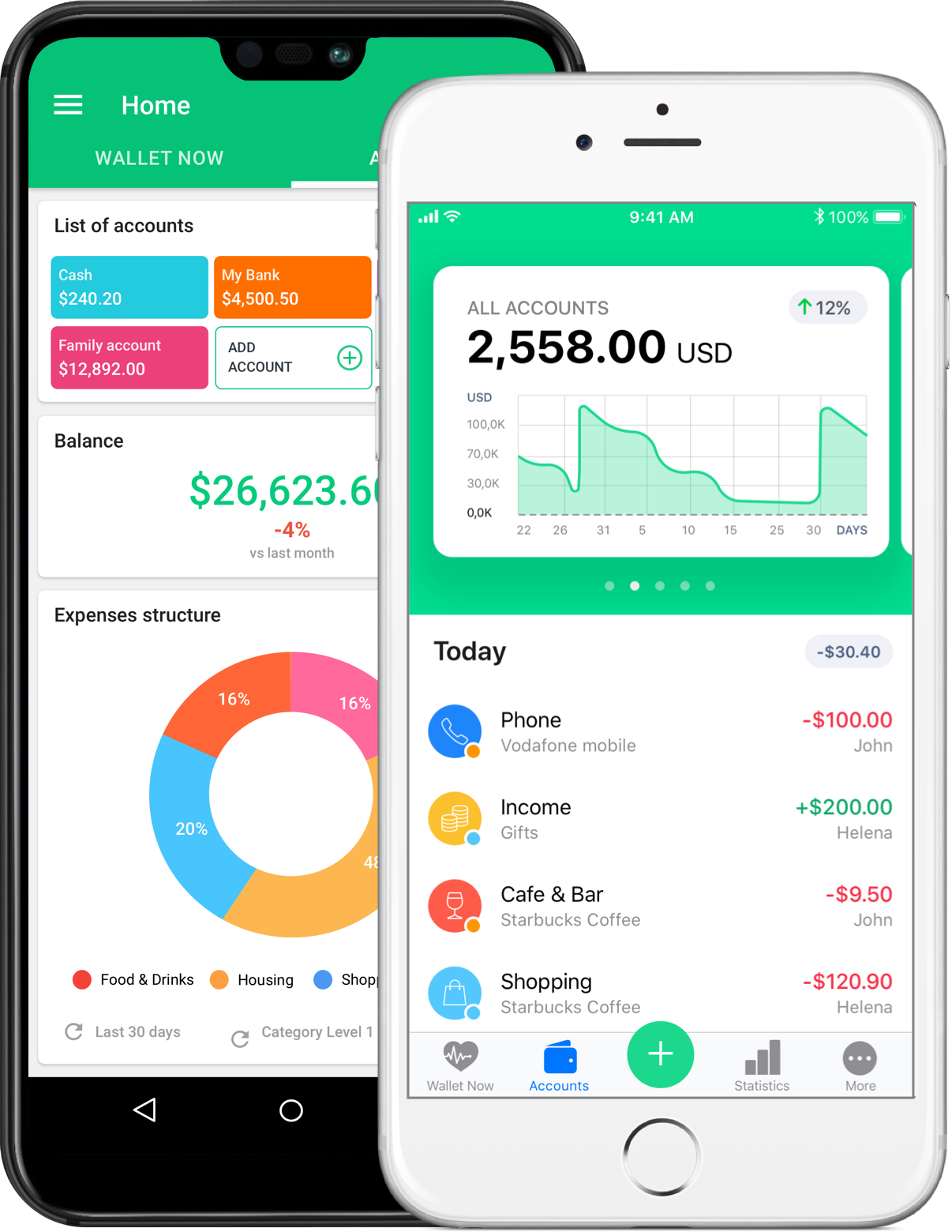

This helps you not spend your money on things you don’t truly need. You can create categories and assign any amount of money to them. You Need A Budget works on a digital zero-based budget, which means you take all the money you earn and divide it across bills, debt, and savings until you have nothing left to allocate. It uses a four rule system: 1. Every dollar has a job YNAB is different from other budgeting apps in that it makes you assign each free dollar to a category, so you can plan where your money is going before you spend it. YNAB’s goal is to teach you their method of being intentional with every dollar you have, and in return, you’ll be in control of your finances. YNAB connects to your bank account and automatically imports transactions, syncs across devices, tracks your spending and savings goals, and more. You Need A Budget is a budgeting app with a simple four-rule method that helps you organize your finances, get rid of debt, and save money. YNAB Canada review What is You Need A Budget (YNAB)?

0 kommentar(er)

0 kommentar(er)